Blog

Light at the end of the tunnel?

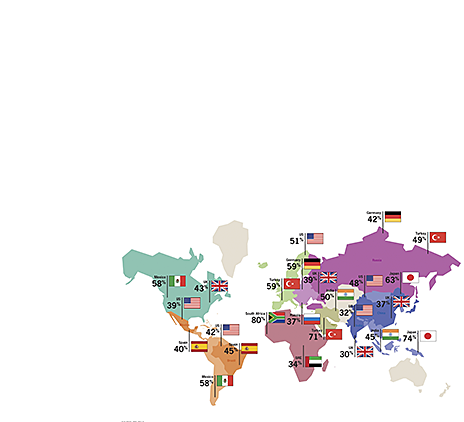

The latest update from our International Business Report (IBR) provided some encouraging signs for the health of the global economy. On the back of easing demand conditions, both investment plans and business confidence are up.